Mt Rebate 2025. The montana department of revenue will begin issuing rebates of 2021 individual income taxes to over 530,000 qualifying montana taxpayers. These bills provide rebates to eligible montana taxpayers for 2021 individual income taxes (hb192) and for 2022 and 2023 property taxes paid on a principal residence (hb222).

(temporary) individual income tax rebate. (temporary) montana surplus rebate account.

The Property Tax Rebate Is A Rebate Of Up To $675 Per Year Of Property Taxes Paid On A Principal Residence.

Updates from the 2023 legislature for tax year 2024.

Reduced Tax Rate And Expanded Montana Earned Income Tax Credit.

There is a rebate available for property taxes paid for tax year 2023.

Mt Rebate 2025 Images References :

Montana Tax Rebates Montana Department of Revenue, How to apply for your property tax. (1) by december 31, 2023, the department of revenue shall issue, to a qualified taxpayer who incurred individual income tax liability in.

Source: mtrevenue.gov

Source: mtrevenue.gov

Are the Montana Tax Rebates Taxable? Tax News You Can Use Montana, Absent a special session, the montana legislature next convenes in 2025, meaning taxpayers may have to wait for relief that is sorely needed today. Each fall, the montana board of housing votes on the final allocation of montana’s housing tax credits for the construction or preservation of affordable homes.

Source: paultan.org

Source: paultan.org

2022 EV LKM road tax rebate Paul Tan's Automotive News, “property taxes are too high. Absent a special session, the montana legislature next convenes in 2025, meaning taxpayers may have to wait for relief that is sorely needed today.

Source: www.unicanews.com.br

Source: www.unicanews.com.br

Agricultor que tingiu cachoeira de azul em MT rebate criticas, The montana department of revenue said wednesday it received more than 226,600 applications for homeowner property tax rebates during the application period that. The montana department of revenue will begin issuing rebates of 2021 individual income taxes to over 530,000 qualifying montana taxpayers.

Source: www.folhamax.com

Source: www.folhamax.com

Presidente da OABMT rebate governador e defende advocacia criminalista, Each fall, the montana board of housing votes on the final allocation of montana’s housing tax credits for the construction or preservation of affordable homes. (temporary) individual income tax rebate.

Source: www.usrebate.com

Source: www.usrebate.com

Unraveling The Montana Tax Rebate 2024 Your Comprehensive Guide, Over this year and next, our $1,350 property tax rebate will provide the average montana homeowner with relief that more than offsets their property. Each fall, the montana board of housing votes on the final allocation of montana’s housing tax credits for the construction or preservation of affordable homes.

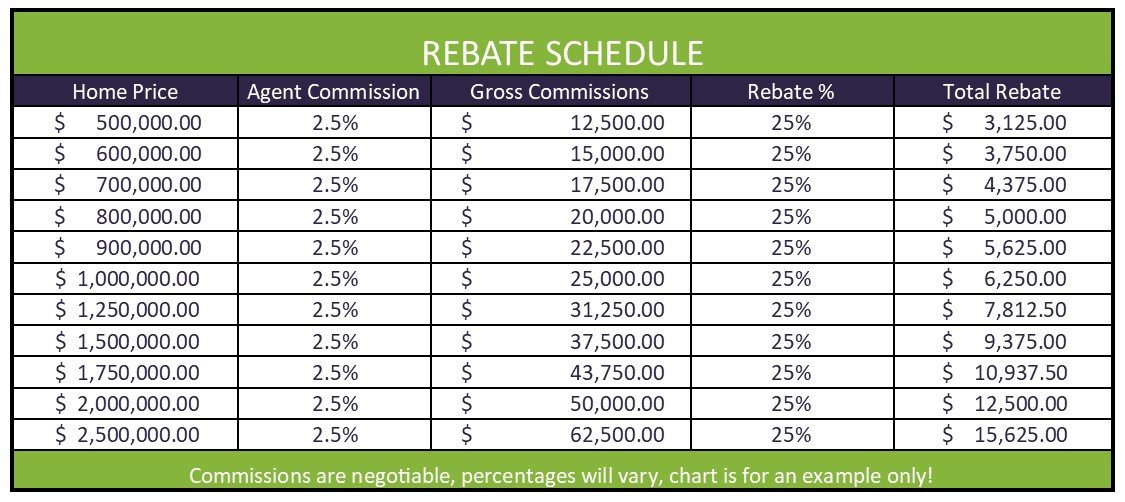

Source: www.barsaminc.com

Source: www.barsaminc.com

REBATES Barsam & Associates Inc., (1) by december 31, 2023, the department of revenue shall issue, to a qualified taxpayer who incurred individual income tax liability in. Updates from the 2023 legislature for tax year 2024.

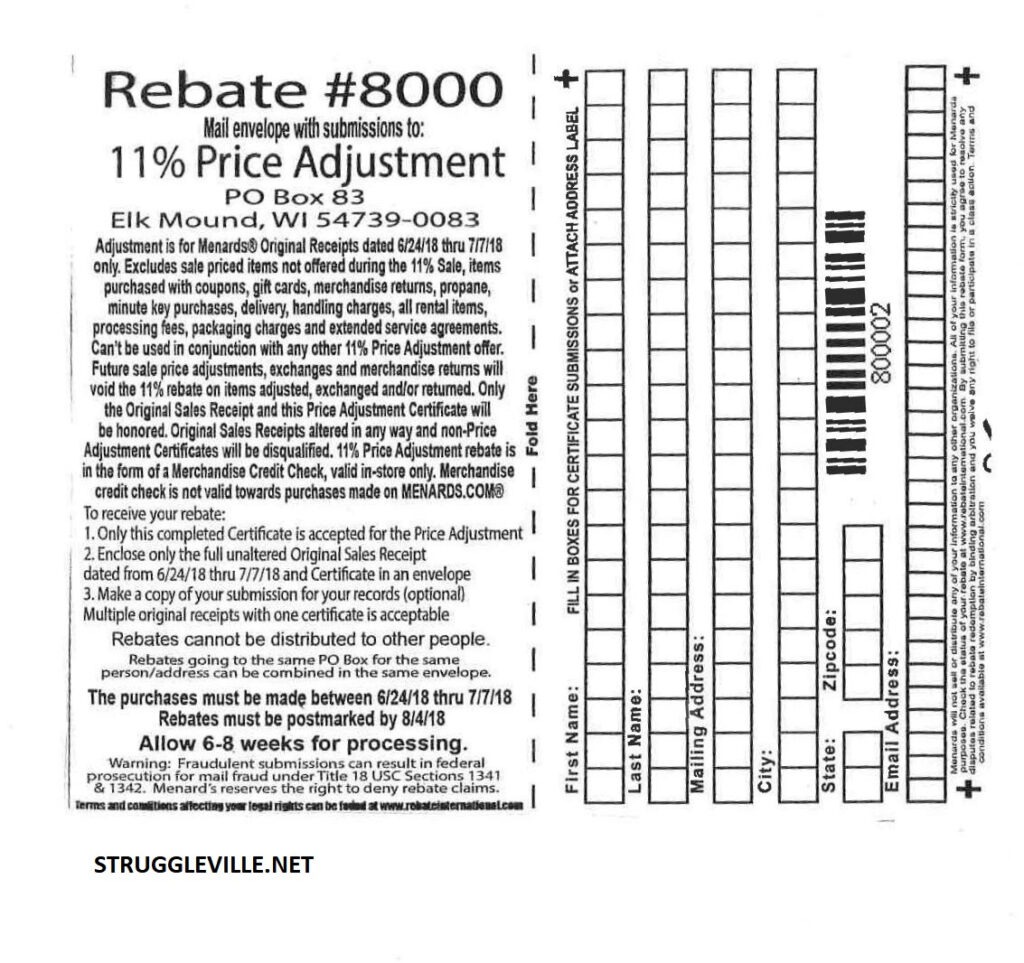

Source: www.menardsrebate-form.com

Source: www.menardsrebate-form.com

Menards Price Adjustment Rebate Form June 2024, Deadline for taxpayers who got a mt tax extension to file their mt income tax return. If a false or fraudulent claim has been paid by the department, the amount paid may be recovered as any other tax owed the state, together with a penalty of 300% of the rebate.

Source: www.menardsrebate-form.com

Source: www.menardsrebate-form.com

Menards Price Adjustment Rebate Form August 2024, The claim must be filed by october 1, 2023. The montana department of revenue will begin issuing rebates of 2021 individual income taxes to over 530,000 qualifying montana taxpayers.

Source: www.greenmountainenergy.com

Source: www.greenmountainenergy.com

Inflation Reduction Act Green Credits and Rebates Green Mountain Energy, The montana department of revenue will begin issuing rebates of 2021 individual income taxes to over 530,000 qualifying montana taxpayers. The montana department of revenue said wednesday it received more than 226,600 applications for homeowner property tax rebates during the application period that.

There Is A Rebate Available For Property Taxes Paid For Tax Year 2023.

(1) by december 31, 2023, the department of revenue shall issue, to a qualified taxpayer who incurred individual income tax liability in.

The Property Tax Rebate Is A Rebate Of Up To $675 Per Year Of Property Taxes Paid On A Principal Residence.

For more information, visit getmyrebate.mt.gov.