Maryland State Tax Forms 2024. See form 502d for the amount to pay with each voucher. If you run into any issues at the polls contact an election protection hotline:

We offer several ways for you to obtain maryland tax forms, booklets and instructions: Individual tax deadline for maryland 2024

The Maryland Estate Tax Is Based On The Maximum Credit For State Death Taxes Allowable Under 2011 Of The Internal Revenue Code.

If you filed your taxes early (good for you!) and have been wondering where your maryland tax refund is, you’re not alone.

.0270 Of Maryland Taxable Income Of $1 Through $50,000;

For taxpayers with filing statuses of single, married filing separately, or dependent, the local tax rates are as follows:

Form Used To Apply For A Refund Of The Amount Of Tax Withheld On The 2024 Sale Or Transfer Of Maryland Real Property Interests By A Nonresident Individual Or Nonresident Entity Which Is In Excess Of The Transferor/Seller's Tax Liability For.

Images References :

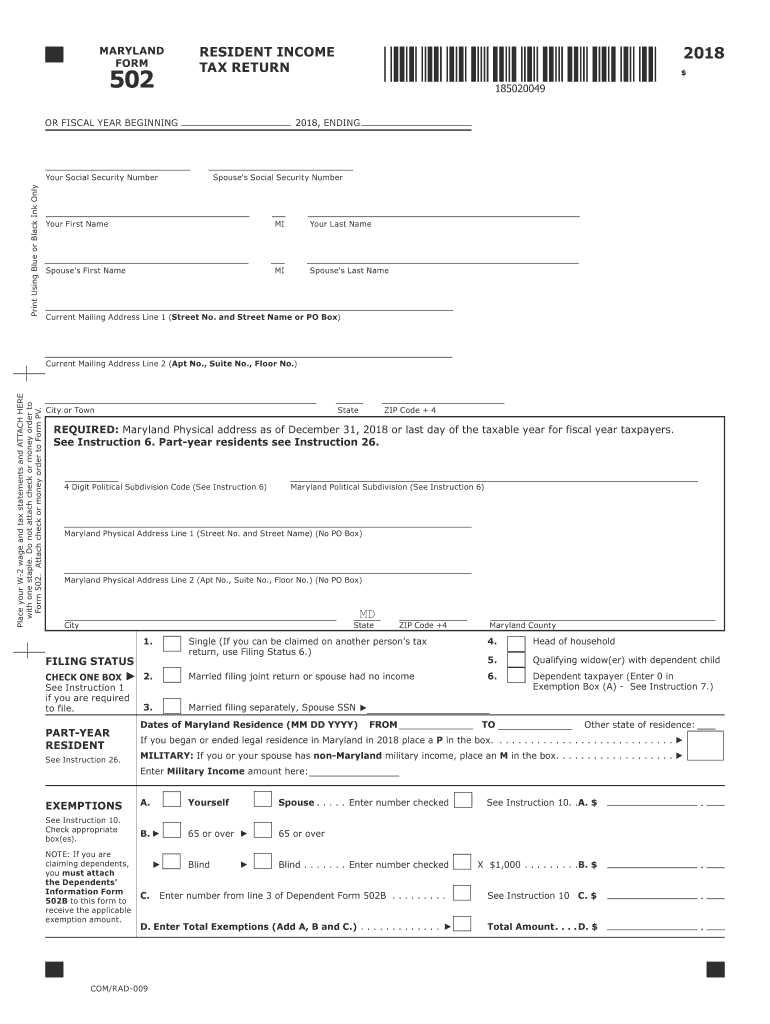

Source: www.dochub.com

Source: www.dochub.com

Form 502d Fill out & sign online DocHub, Earned income tax credit (eitc) mva tax certification. You can pay your maryland taxes with a personal check, money order or credit card.

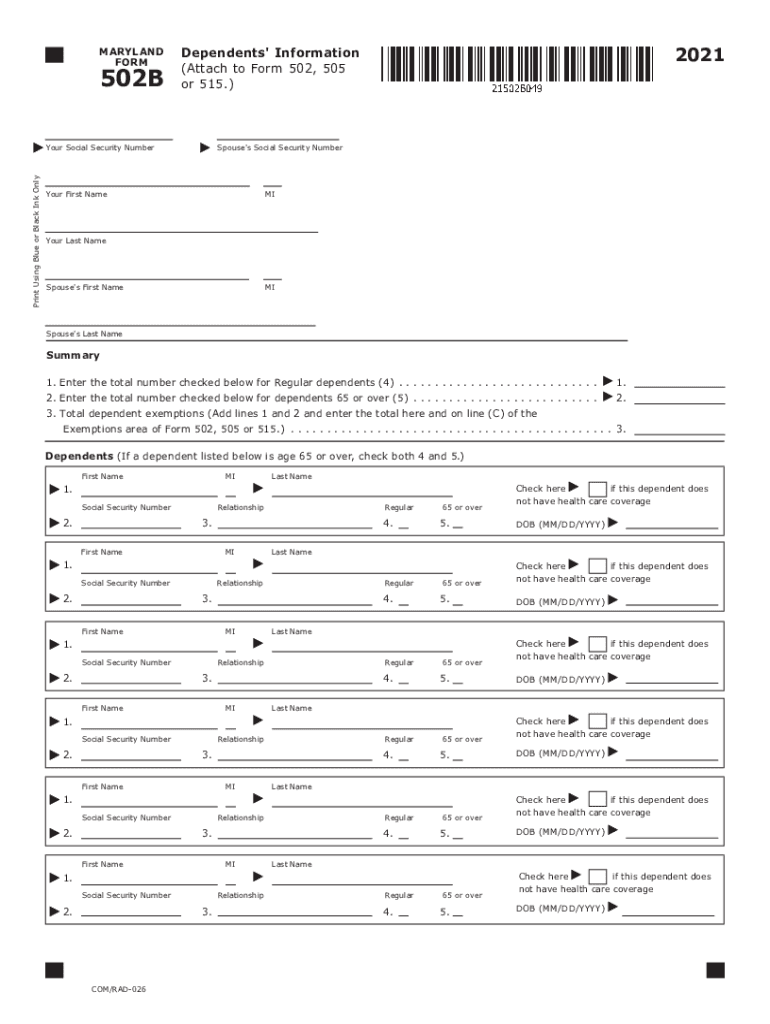

Source: www.signnow.com

Source: www.signnow.com

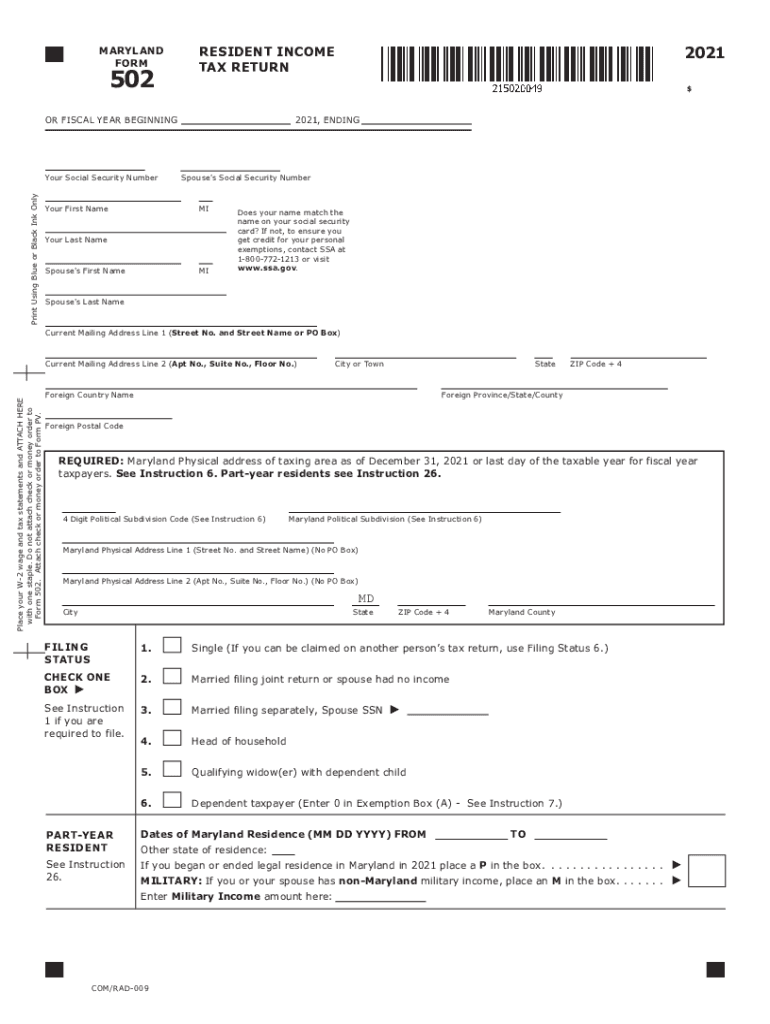

Maryland State Tax S 20182024 Form Fill Out and Sign Printable PDF, Instructions for filing personal income tax returns for nonresident individuals. The maryland estate tax is based on the maximum credit for state death taxes allowable under 2011 of the internal revenue code.

Source: www.signnow.com

Source: www.signnow.com

Maryland 502 Booklet 20212024 Form Fill Out and Sign Printable PDF, Find your pretax deductions, including 401k, flexible account contributions. The credit used to determine the maryland estate tax cannot exceed 16% of the amount by which the decedent's taxable estate exceeds the maryland estate tax exemption amount for the year of the decedent's death.

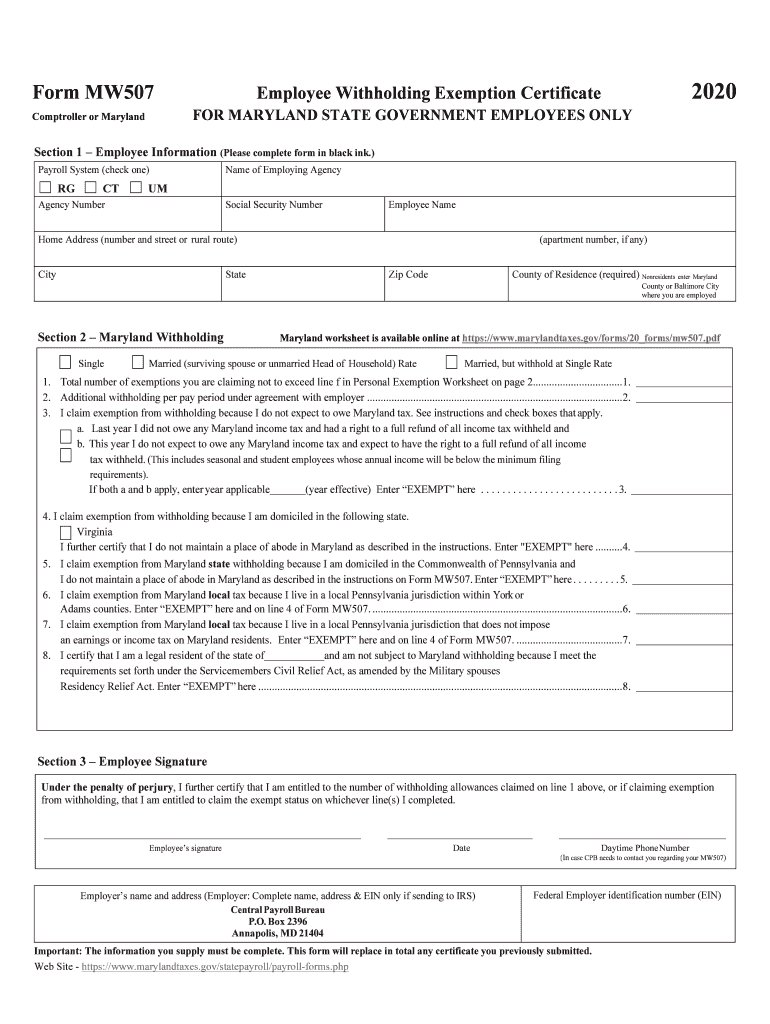

Source: w4formsprintable.com

Source: w4formsprintable.com

Maryland W4 2021 2022 W4 Form, Visit any of our taxpayer service offices to obtain forms. Individual tax deadline for maryland 2024

Source: www.dochub.com

Source: www.dochub.com

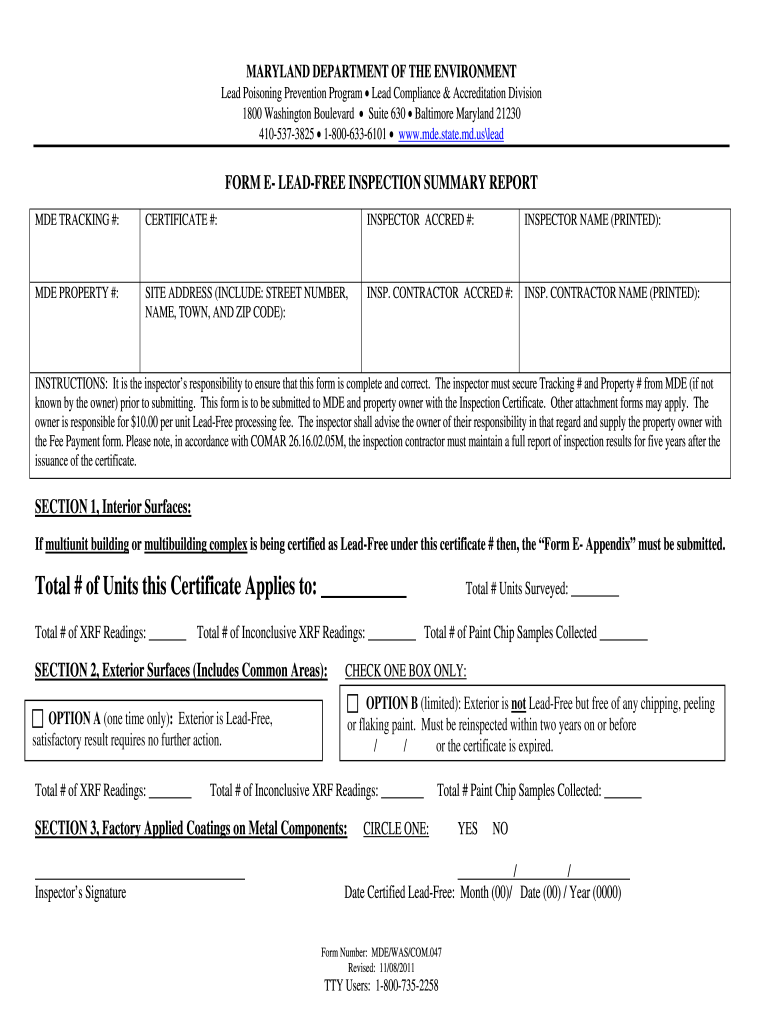

Form 129 maryland Fill out & sign online DocHub, How to calculate 2024 maryland state income tax by using state income tax table. 2023 sales and use tax forms.

Source: www.uslegalforms.com

Source: www.uslegalforms.com

Maryland Form 202 20202022 Fill and Sign Printable Template Online, By mail tuesday, apr 23, 2024 registration form. If you file and pay electronically by april 15, you have until april 30 to make the electronic payment, using direct debit or a credit card.

Source: www.dochub.com

Source: www.dochub.com

Maryland sales and use tax form Fill out & sign online DocHub, Maryland income tax brackets 2024. See form 502d for the amount to pay with each voucher.

Source: federal-withholding-tables.net

Source: federal-withholding-tables.net

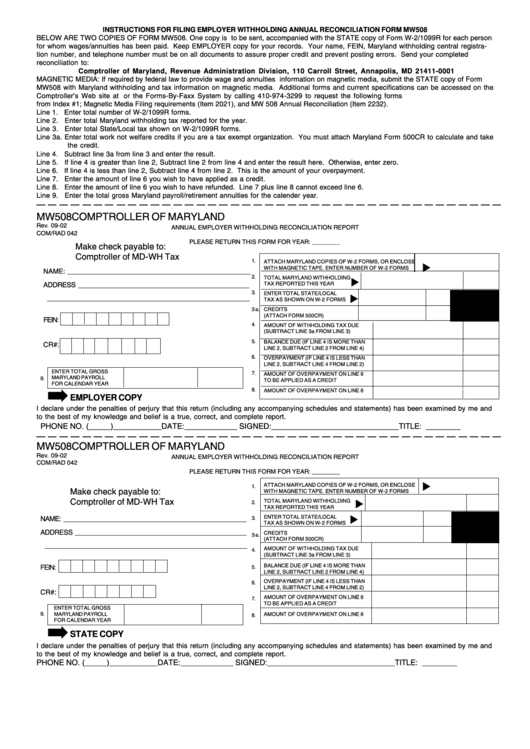

Maryland Employer Tax Withholding 2021 Federal Withholding Tables 2021, What's new for the 2024 tax filing season (2023 tax year) here are some of the most important changes and benefits affecting the approximately 3.5 million taxpayers working on their 2023 maryland income tax returns. Application all business tax forms

Source: www.dochub.com

Source: www.dochub.com

Maryland form 502 Fill out & sign online DocHub, .0270 of maryland taxable income of $1 through $50,000; The maryland office of the comptroller stopped processing tax returns from jan.

Source: www.formsbank.com

Source: www.formsbank.com

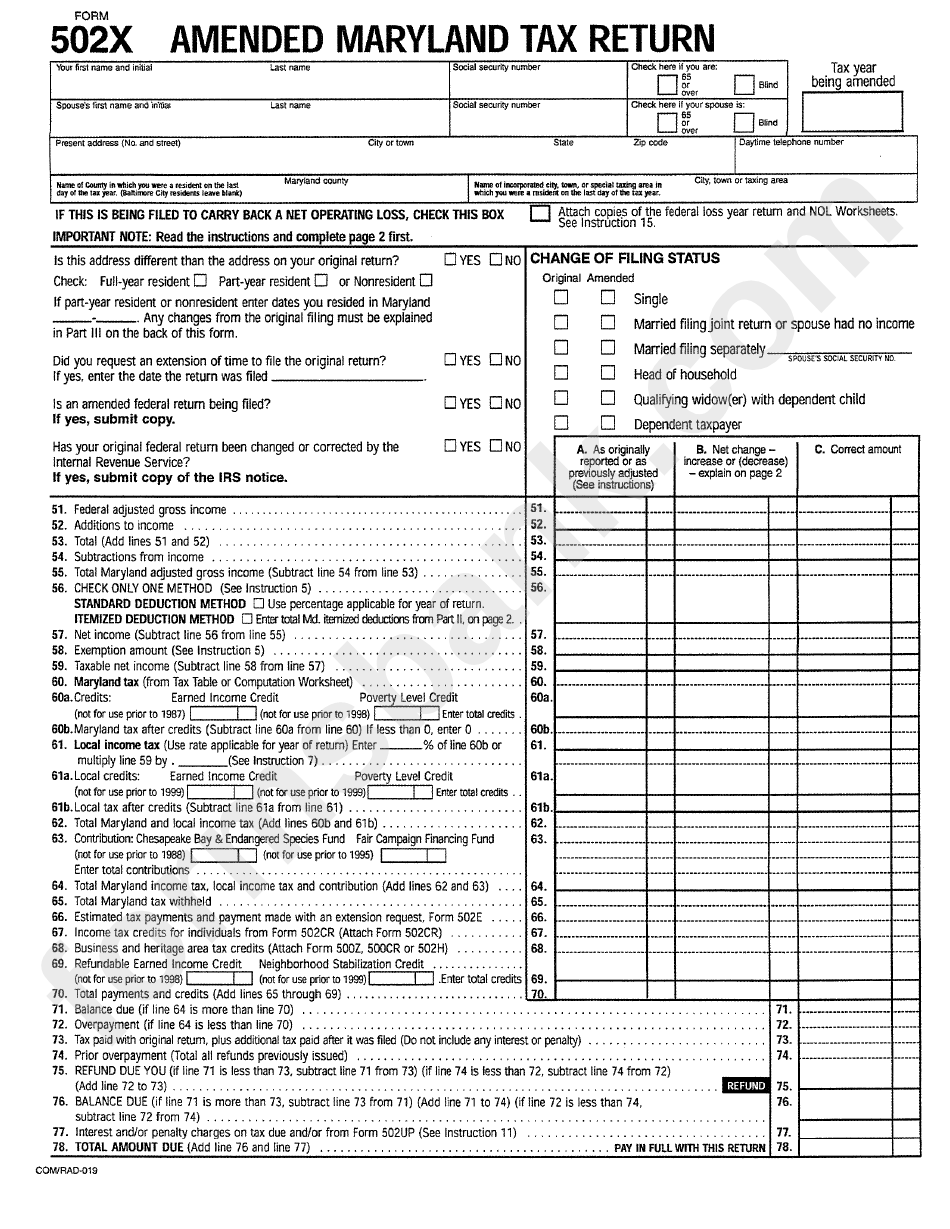

Form 502x Amended Maryland Tax Return printable pdf download, The maryland house has approved tax and fee hikes in budget legislation for the next fiscal year, part of a $1.3 billion. See form 502d for the amount to pay with each voucher.

The Maryland Estate Tax Is Based On The Maximum Credit For State Death Taxes Allowable Under 2011 Of The Internal Revenue Code.

2020 individual income tax instruction booklets.

Taxpayer Services (Tsd) Board Of Public Works (Bpw) Bureau Of Revenue Estimates (Bre) Central Payroll Bureau (Cpb) Office Of Communications (Ooc) Compliance Division (Cd).

To vote in person on election days, vote at your assigned polling place.